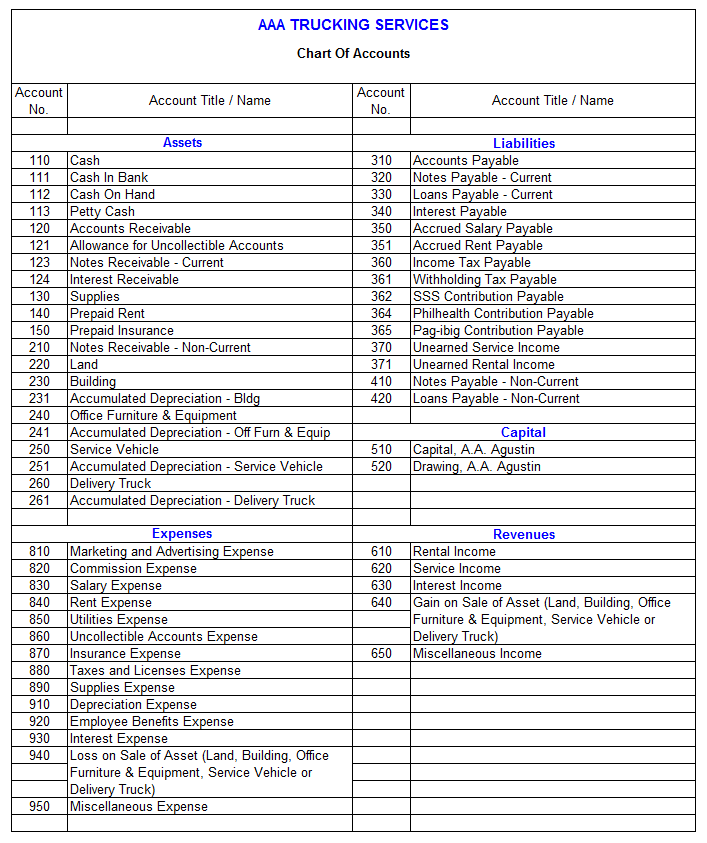

The Chart of Accounts should be reviewed at least once a year to ensure it is up-to-date with any changes in business operations. Additionally, any significant changes should be reflected in the Chart of Accounts as soon as possible. Current liabilities are classified as any outstanding payments that are due within the year, while non-current or long-term liabilities are payments due more than a year from the date of the report. Revenue is the amount of money your business brings in by selling its products or services to clients.

Income accounts

Long-term liabilities are financial obligations that are due after more than one year. Financing through long-term liabilities allows a business to manage its immediate cash flow needs while planning for its long-term strategy. It provides a detailed framework for analyzing past transactions, invaluable for projecting future financial performance.

Best Free Accounting Software of 2024

Back when we did everything on paper, or if you’re using a system like Excel for your bookkeeping and accounting, you used to have to pick and organize these numbers yourself. But because most accounting software these days will generate these for you automatically, you don’t have to worry about selecting reference numbers. Revenue accounts keep track of any income your business brings in from the sale of goods, services or rent. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. For instance, if you rent, the money moves from your cash account to the rent expense account. Expense accounts allow you to keep track of money that you no longer have.

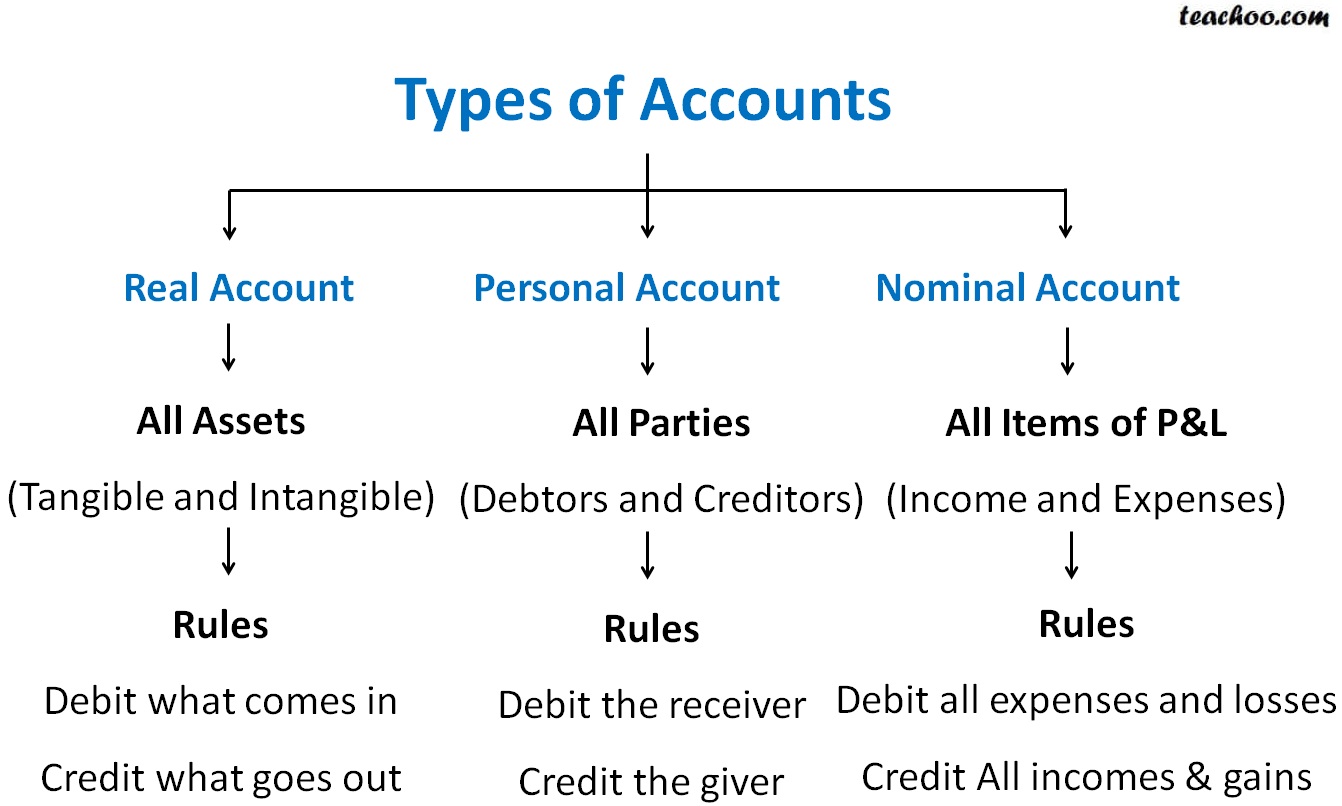

The four main account types in a chart of accounts list

Because transactions are displayed as line items, they can quickly be found and assessed. This is crucial for providing investors and other stakeholders a bird’s-eye view of a company’s financial data. To make it easy for readers to locate specific accounts or to know what they’re looking at instantly, each COA typically contains identification codes, names, and brief descriptions your xero accounting dashboard for accounts. A well-designed chart of accounts should separate out all the company’s most important accounts, and make it easy to figure out which transactions get recorded in which account. They represent what’s left of the business after you subtract all your company’s liabilities from its assets. They basically measure how valuable the company is to its owner or shareholders.

For example, manufacturing may need different codes to a retail business. A chart of accounts (COA) is a structured list of an organization’s financial accounts used to categorize and record financial transactions. It serves as the backbone of an accounting system, providing a framework for organizing financial data in a logical manner.

- A standard COA will be a numbered list of the accounts that fill out a company’s general ledger, acting as a filing system that categorizes a company’s accounts.

- If you create too many categories in your chart of account, you can make your entire financial reports difficult to read and analyze.

- These are asset accounts, liability accounts, equity accounts, revenue accounts, and expense accounts.

- The first digit in the account number refers to which of the five major account categories an individual account belongs to—“1” for asset accounts, “2” for liability accounts, “3” for equity accounts, etc.

- As I close, let me encourage you to give your chart of account decisions plenty of thought.

- You can think of this like a rolodex of accounts that the bookkeeper and the accounting software can use to record transactions, make reports, and prepare financial statements throughout the year.

A chart of accounts, or COA, is a list of all your company’s accounts, together in one place, that is a part of your business’s general ledger. It provides you with a birds eye view of every area of your business that spends or makes money. The main account types include Revenue, Expenses, Assets, Liabilities, and Equity. The reports play a crucial role in both the monthly financial management and the annual financial review process.

We believe everyone should be able to make financial decisions with confidence. She would then make an adjusting entry to move all of the plaster expenses she already had recorded in the “Lab Supplies” expenses account into the new “Plaster” expenses account. To do this, she would first add the new account—“Plaster”—to the chart of accounts. Instead of recording it in the “Lab Supplies” expenses account, Doris might decide to create a new account for the plaster. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. Asset accounts can be confusing because they not only track what you paid for each asset, but they also follow processes like depreciation.

Your COA is a useful document that lets you present all the financial information about your business in one place, giving you a clear picture of your company’s financial health. To better understand how this information is typically presented, you may want to review a sample of financial statement. This can help you visualize how your chart of accounts translates into formal financial reporting. At its core, a chart of accounts is a list of all the individual financial accounts a business uses. Assets play an essential role in a chart of accounts as they represent the resources a company owns or controls that are expected to provide future benefits. In a chart of accounts, assets are usually classified into current or non-current categories.

Similar to a chart of accounts, an accounting template can give you a clear picture of your business’s financial information at a glance. Utilizing accounting tools like these will ensure a better workflow, helping you grow your company. FreshBooks offers a wide variety of accounting tools, like accounting software, that make it easier to stay organized. A chart of accounts (COA) is an index of all of the financial accounts in a company’s general ledger. In short, it is an organizational tool that lists by category and line item all of the financial transactions that a company conducted during a specific accounting period. Small businesses may record hundreds or even thousands of transactions each year.